Uncovering four essential business concepts

Ready, Set, StartUP is an entertaining new business reality series currently streaming on Amazon Prime Video. The show throws the spotlight on ten ambitious entrepreneurs armed with unique business ideas and competing fiercely to secure a £100k investment and invaluable business support.

Amidst intense drama and competition, the series underscores some crucial business concepts. From the second to the fifth episode, four industry mentors guide the contestants on a different topic each, culminating in a surprise medley in the final episode.

Let's unpack the key insights from Ready, Set, StartUP, focusing on the four main themes: Market segmentation, business model, competitive advantage, and market validation.

Market Segmentation: Find your tribe!

Successful businesses cater to the unique needs of their specific audience. This can be done through a thorough analysis of the market, identifying key demographic, geographic, psychographic, and behavioural factors. By segmenting the market effectively, startups can develop tailored marketing strategies that resonate with their target customers, ultimately leading to increased efficiency and improved customer satisfaction.

In the second episode, the show's first mentor Roberta Lucca joins the contestants to walk them through the nuts and bolts of market segmentation. In the challenge, the contestants have to apply this knowledge in a real-life case study and come up with alternative ideas for the streaming platform 'Heygo', aiming to tailor the idea as much as possible to the needs and wants of the target audience.

Business Model: The golden goose!

An idea might spark the startup flame, but it's the business model that fuels the fire. In the third episode, business mentor Steve Lindsay from SFC Capital is pressing the contestants on how their business models are generating revenue. A well-defined business model lays out the strategy for generating revenue, delivering value to customers and ensuring profitability.

"Many people think that having a clever idea is key to a successful startup." says Steve Lindsay, "The idea is the easy part – I have 10 good ones every week! A successful startup is about execution: planning, tweaking and hard, hard work! Remember – Facebook was once just an idea on the back of an envelope."

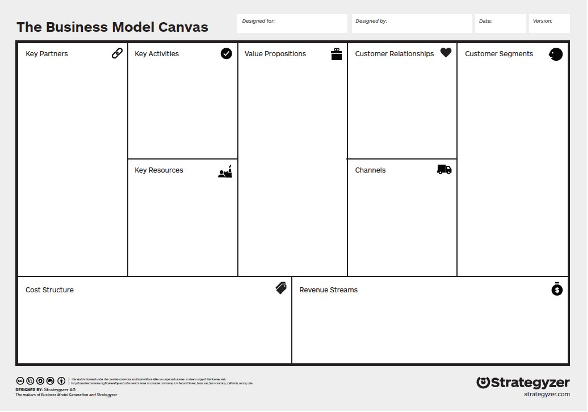

Drawing from the identified market segments, a good business model then sketches out a central value proposition. With this proposition at the core, it's crucial to ensure the right resources, activities, partnerships, and channels are at your disposal to bring it to fruition. The real challenge, however, lies in balancing the startup's income sources against its cost framework. One renowned model that simplifies this process is Alexander Osterwalder's Business Model Canvas.

In the show, the contestants create a marketing agency and produce a promotional video for an upcoming venue in the heart of London. They need to effectively capture the value proposition and produce something that excites the customer segments and builds the foundation for great customer relationships.

Competitive Advantage: Stand out or fade out!

In a crowded marketplace, having a unique selling point (USP) is essential for standing out from the competition. Mentor Alison Edgar was invited onto the show to explain to the founders how to identify and leverage their competitive advantages to gain traction in their respective industries. Whether it's through innovative product features, exceptional customer service, or disruptive pricing strategies, entrepreneurs need the ability to differentiate themselves and capture market share.

There are several different models that startups could use to determine their competitive advantage. One is the resource-based view (RBV) which defines a company's competitive advantage as an outcome of unique resources and capabilities. If a resource or capability is unique, hard to imitate, and valuable to the organisation, it is considered a sustainable competitive advantage. In contrast, the dynamic capabilities view (DCV) assumes that competitive advantage can be created, sustained, and eroded over time, so a startup needs to be able to constantly sense new opportunities, reconfigure their offering, energise the workforce, and learn as an organisation.

In the show, the entrepreneurs are prompted to analyse the brand of a local tea shop to then organise a bespoke event based on their findings and properly incorporate the brand's value into their offering at the event.

Market Validation: Test, refine, repeat!

Market validation is a crucial step in the entrepreneurial journey, ensuring that a product or service meets customer expectations and demands. Ready Set StartUP showcases the significance of prototype testing as a means to gather feedback, refine the offering, and validate the market opportunity. Founders need to actively engage with potential customers, seeking their opinions, and iteratively improving their prototypes based on the feedback received. This iterative process helps entrepreneurs refine their value proposition and address any gaps or pain points, ultimately increasing the likelihood of success.

After mentor Ying Tan prompts the contestants to set up focus groups, the contestants have to create prototypes of their products and test them with potential customers. This exercise helps them to gather valuable feedback and make necessary improvements before launching their businesses. Some go very well with lots of feedback from customers, and some of them not really – but I'll leave it for yourself to see.

Wrap-up

Ready, Set StartUP is more than a reality show. It surely is entertaining but it's also a crash course in entrepreneurship, offering a goldmine of insights into the dynamic business world. As viewers, we learn from the contestants' experiences, observing their adaptability and resilience in the face of intense competition. The show provides a roadmap for navigating the entrepreneurial landscape, making it an invaluable resource for anyone embarking on a business venture.

Extra resources

- Strategyzer – Business Model Canvas

- Chumphong, Srimai & Potipiroon (2020). The Resource-Based View, Dynamic Capabilities and SME Performance for SMEs to Become Smart Enterprises

.png?width=2000&height=318&name=SFC%20Logo%20+%20Title%20x%20web%20(white).png)

.png?width=600&height=296&name=Young%20talent%20(1).png)

%20(white%3B%20104%20x%2050px).webp?width=520&height=250&name=SFC%20Web%20-%20HP%20-%20Partner%20Logos%20-%20British%20Business%20Bank%20(BBB%20BBI)%20(white%3B%20104%20x%2050px).webp)

%20-%20Home%20Grown.webp?width=520&height=250&name=SFC%20Web%20-%20HP%20-%20Partner%20Logo%20(white%3B%20104%20x%2050px)%20-%20Home%20Grown.webp)

%20-%20Markel.webp?width=520&height=250&name=SFC%20Web%20-%20HP%20-%20Partner%20Logo%20(white%3B%20104%20x%2050px)%20-%20Markel.webp)